Free 1099 Printable Form

Get NowFiling Your 1099 Form Made Easy

Today, we'll address an important subject that puzzles many taxpayers – Form 1099. The document may seem like a maze but don't worry. We've got your back. Let's explore some situations where you might need to file this form and how to use a free printable 1099 form in the current year.

You might be an independent contractor, a freelancer, or self-employed. You may have won the lottery or received rental income. These are just a few scenarios where you might be required to report your income using the 1099 tax form for free. If you find yourself in any of these situations, be assured that it's not as complex as it initially seems.

IRS Tax Form 1099: Dealing with Errors

No one is perfect; we all make mistakes. So, what happens if you stumble upon an error on the free 1099 employee form printable after you've already it? Don't panic! There are straightforward steps you can follow to correct the error. Filing a corrected form promptly can save you a lot of stress and potential penalties. Hence, as much as the process may seem daunting, it is essential to correct the errors promptly.

1099 Online Form: Guarding Your Privacy

In this digital age, the convenience of filing your forms online can't be overstated. Nonetheless, you must take measures to ensure your personal information is secure. As you file the 1099-MISC for free online, always remember to do it over a secure network to shield your sensitive data from prying eyes. Protecting your personal data is just as critical as correctly filing your tax returns.

Handy FAQs about 1099 Forms

Before we wrap up, here are some frequently asked questions about the free 1099 printable form for independent contractors.

- Are freelance graphic design services subject to 1099 form reporting?

Yes, if you paid at least $600 to a graphic designer during the tax year, you must report this payment on Form 1099-NEC. The designer, in turn, is responsible for reporting this income on their individual tax return. - If I win a large sum in a fantasy sports league, will I receive a 1099 form?

If you win over $600 in a fantasy sports league, the organizer must send you a Form 1099-MISC. The money won is considered taxable income and needs to be reported on your tax return. - Can I ignore a 1099-C form relating to a canceled debt?

No, ignoring a 1099-C can lead to tax complications. A 1099-C form reports income from the cancellation of debt. The IRS considers canceled debt income; thus, it should be included in your gross income on your tax return. You may, however, qualify for an exception or exclusion, such as bankruptcy or insolvency.

Related Forms

-

![image]() 1099 In the world of taxation, the IRS Form 1099 holds a unique importance. It's a series of documents that the Internal Revenue Service (IRS) refers to as "information returns." There are a variety of 1099 forms, with each outlining the income an individual receives from sources that are not typical employment. Examples count as non-wage income, such as payments to independent contractors, interest from a bank, royalties, and miscellaneous income. Therefore, the 1099 contractor form records that an... Fill Now

1099 In the world of taxation, the IRS Form 1099 holds a unique importance. It's a series of documents that the Internal Revenue Service (IRS) refers to as "information returns." There are a variety of 1099 forms, with each outlining the income an individual receives from sources that are not typical employment. Examples count as non-wage income, such as payments to independent contractors, interest from a bank, royalties, and miscellaneous income. Therefore, the 1099 contractor form records that an... Fill Now -

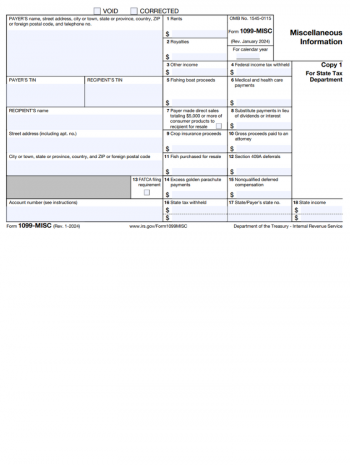

![image]() Printable 1099 Form One important aspect that helps in the seamless filing of your taxes involves understanding the structure of the free 1099 printable form. The top section captures your details as the payer, the receiver's personal details, and their tax identification number, as well as your unique taxpayer identification number. The form is divided into several sections, each addressing a different income category. For instance, section 7 indicates 'Nonemployee Compensation', where independent contractors would report their earnings if they fall above the $600 threshold. Other sections capture amounts concerning royalties, rent, or other forms of income. Fill in the 1099 Printable Form Correctly Correctly filling in the blank printable 1099 form is essential to avoid any last-minute hassle. Here is a simple guide to help you: Ensure you have all the necessary informationBegin by supplying your complete personal details. This includes your full name, address, contact information, and, if applicable, your tax identification number (such as your Social Security Number or TIN). Accurately input all detailsIf the form requires income-related information, gather all necessary earnings data. This can encompass salary details, dividends, interest income, or any other relevant financial information. Ensure these figures are accurate and up-to-date. Double-check the filled formCarefully enter all data, paying close attention to numerical values, dates, and any other specific information. Typos and errors can lead to delays or complications down the line. Steps to Submit the 1099 Tax Form Once your printable 1099 form for employees is filled out, you must submit it to the IRS. Here is a simple step-by-step guide: Review your formMake sure all sections are completed and the information provided is accurate. You wouldn't want the IRS sending your form back down the line. Submit the 1099 reportYou can send your form either by mail or electronically. If you select mail, it's wise to send it through registered post to keep a tracking record. Keep a copyAlways keep a duplicate of the submitted printable IRS Form 1099-MISC for your records. This could help handle any discrepancies in the future. Remember the Deadline The deadline to file a printable 1099 form for 2023 with the IRS is typically set for January 31 of the year following the tax year. For instance, if you are filing for the tax year 2023, your form should reach the IRS no later than January 31, 2024. Remember, tax filing doesn't have to be a daunting task. By understanding the form structure and following simple steps, you can fill and submit your printable 1099 form correctly. Fill Now

Printable 1099 Form One important aspect that helps in the seamless filing of your taxes involves understanding the structure of the free 1099 printable form. The top section captures your details as the payer, the receiver's personal details, and their tax identification number, as well as your unique taxpayer identification number. The form is divided into several sections, each addressing a different income category. For instance, section 7 indicates 'Nonemployee Compensation', where independent contractors would report their earnings if they fall above the $600 threshold. Other sections capture amounts concerning royalties, rent, or other forms of income. Fill in the 1099 Printable Form Correctly Correctly filling in the blank printable 1099 form is essential to avoid any last-minute hassle. Here is a simple guide to help you: Ensure you have all the necessary informationBegin by supplying your complete personal details. This includes your full name, address, contact information, and, if applicable, your tax identification number (such as your Social Security Number or TIN). Accurately input all detailsIf the form requires income-related information, gather all necessary earnings data. This can encompass salary details, dividends, interest income, or any other relevant financial information. Ensure these figures are accurate and up-to-date. Double-check the filled formCarefully enter all data, paying close attention to numerical values, dates, and any other specific information. Typos and errors can lead to delays or complications down the line. Steps to Submit the 1099 Tax Form Once your printable 1099 form for employees is filled out, you must submit it to the IRS. Here is a simple step-by-step guide: Review your formMake sure all sections are completed and the information provided is accurate. You wouldn't want the IRS sending your form back down the line. Submit the 1099 reportYou can send your form either by mail or electronically. If you select mail, it's wise to send it through registered post to keep a tracking record. Keep a copyAlways keep a duplicate of the submitted printable IRS Form 1099-MISC for your records. This could help handle any discrepancies in the future. Remember the Deadline The deadline to file a printable 1099 form for 2023 with the IRS is typically set for January 31 of the year following the tax year. For instance, if you are filing for the tax year 2023, your form should reach the IRS no later than January 31, 2024. Remember, tax filing doesn't have to be a daunting task. By understanding the form structure and following simple steps, you can fill and submit your printable 1099 form correctly. Fill Now -

![image]() Federal Form 1099-MISC Discussing income and taxes can become complex. However, it's essential to understand these concepts for all people managing financial activities. In particular, some people need to fill out the 1099-MISC form because it carries significant implications for an individual's income tax reporting. Commonly referred to as the Miscellaneous Income form, the federal form 1099-MISC acts as a record of the money you earned from a source outside of your regular employment. This might include payments due to a side gig, dividends from your investments, royalties from a creative project, and other similar income sources. Fillable 1099-MISC Form - Recent Changes Over the years, the IRS has implemented some key changes to the 1099-MISC template to make it easier for taxpayers to report their diverse income sources. One notable amendment is the addition of new boxes specifically designed to report income from a freelancer or gig economy job. So now, taxpayers find it much easier to separate these types of income from their standard employment earnings. Who Should Fill Out the 1099-MISC? The blank 1099-MISC form is typically used by businesses to document payments made to non-employee workers, such as independent contractors, freelancers, or consultants. The form acts as a confirmation of non-employee compensation. However, there are some exceptions. For example, businesses don’t need to issue this form for payments made to corporations or for payments of less than $600 in a year. On the other hand, as an individual, you may need to fill out the 1099-MISC form as proof of your income from such payments when you file your income tax return. It’s important to note that you should confirm with your tax advisor to understand if you fall under these eligible categories and if there are any exemptions. Tips for the 1099-MISC Form for 2023 While the process might sound daunting at first, it doesn’t have to be. Here are a few tips to optimize your experience of filling out the 1099-MISC form: Ensure you have accurate records of your income sources. It's crucial to document your earnings methodically throughout the year to simplify the process of filling in the form. If you’re unsure about any specific information or if it’s your first time filing the form, consider seeking advice from a tax consultant or use tax software that can guide you through the process and offer prompts along the way. Don't wait until the last minute. Gather all necessary information well ahead of the tax deadline to avoid any last-minute stress. Remember this process is necessary, and with some careful planning, it can be smoothly executed. Lastly, to make the task more straightforward, you might want to file the 1099-MISC online. It's a quick, efficient method that allows instant submission and easy tracking of your form submission status. Plus, it reduces the chances of misplacing or damaging your physical document. Fill Now

Federal Form 1099-MISC Discussing income and taxes can become complex. However, it's essential to understand these concepts for all people managing financial activities. In particular, some people need to fill out the 1099-MISC form because it carries significant implications for an individual's income tax reporting. Commonly referred to as the Miscellaneous Income form, the federal form 1099-MISC acts as a record of the money you earned from a source outside of your regular employment. This might include payments due to a side gig, dividends from your investments, royalties from a creative project, and other similar income sources. Fillable 1099-MISC Form - Recent Changes Over the years, the IRS has implemented some key changes to the 1099-MISC template to make it easier for taxpayers to report their diverse income sources. One notable amendment is the addition of new boxes specifically designed to report income from a freelancer or gig economy job. So now, taxpayers find it much easier to separate these types of income from their standard employment earnings. Who Should Fill Out the 1099-MISC? The blank 1099-MISC form is typically used by businesses to document payments made to non-employee workers, such as independent contractors, freelancers, or consultants. The form acts as a confirmation of non-employee compensation. However, there are some exceptions. For example, businesses don’t need to issue this form for payments made to corporations or for payments of less than $600 in a year. On the other hand, as an individual, you may need to fill out the 1099-MISC form as proof of your income from such payments when you file your income tax return. It’s important to note that you should confirm with your tax advisor to understand if you fall under these eligible categories and if there are any exemptions. Tips for the 1099-MISC Form for 2023 While the process might sound daunting at first, it doesn’t have to be. Here are a few tips to optimize your experience of filling out the 1099-MISC form: Ensure you have accurate records of your income sources. It's crucial to document your earnings methodically throughout the year to simplify the process of filling in the form. If you’re unsure about any specific information or if it’s your first time filing the form, consider seeking advice from a tax consultant or use tax software that can guide you through the process and offer prompts along the way. Don't wait until the last minute. Gather all necessary information well ahead of the tax deadline to avoid any last-minute stress. Remember this process is necessary, and with some careful planning, it can be smoothly executed. Lastly, to make the task more straightforward, you might want to file the 1099-MISC online. It's a quick, efficient method that allows instant submission and easy tracking of your form submission status. Plus, it reduces the chances of misplacing or damaging your physical document. Fill Now -

![image]() Federal Tax Form 1099 Simply put, the income tax form 1099 is a crucial document used in the United States for tax purposes. This form is specifically meant for reporting the various types of income an individual may receive other than the salary paid by their employer. This miscellaneous income can span from dividends and royalties to self-employment earnings and bank interest. Getting a blank 1099 tax form is the first step in preparing to report your miscellaneous income. This form acts as a kind of roadmap, guiding how to describe and record your non-wage income accurately. The importance of this form shouldn’t be underestimated - it can make the difference between a smooth tax experience and unexpected back taxes or penalties. Who Can't Use the 1099 Tax Form While it's a powerful tool, not everyone can use the federal tax form 1099. It's specifically designed for individual taxpayers—not corporations. If you're a company or other business organization, you'll need to use other forms to report your income, such as Form 1120 for corporations or Form 1065 for partnerships. Government entities, tax-exempt organizations, and certain other entities are also ineligible to use Form 1099. Form 1099 on a Real-Life Example Let's consider a scenario: imagine you are a freelance graphic designer who also earns a bit of income from a hobby of creating and selling handmade crafts. You need to report both income streams, but neither is tied to a traditional employer who pays you a regular salary. In this case, you would use Form 1099 to report these additional earnings. It shows the IRS that you’re not just a salaried employee but also have income from self-employment and other sources. You must print the 1099 tax form, fill it out correctly, and submit it with your regular income tax filing. Common Issues & Their Solutions Incorrect or Missing Taxpayer Identification Number (TIN)If you receive a notice from the IRS about a TIN mismatch, provide the correct TIN to the payer or the IRS as requested. Missing 1099 FormsContact the payer and request a copy of the missing 1099 form. You can also report the income based on your records if necessary. Failure to Report All IncomeIf you realize you omitted income, file the 1099 tax form but its amended copy with the correct information and pay any additional taxes owed. Mismatched Income AmountsContact the payer to resolve discrepancies. If the payer made an error, request a corrected 1099 form. Not Keeping Backup RecordsYou can refer to your backup records if you lose your copies or need to provide documentation. By better understanding Form 1099, you can take control of your income, better understand your tax obligations, and avoid potential complications. Hopefully, this essential guide has clarified its purpose, highlighted who can't use it, shown practical applications, and addressed common issues people often encounter. Fill Now

Federal Tax Form 1099 Simply put, the income tax form 1099 is a crucial document used in the United States for tax purposes. This form is specifically meant for reporting the various types of income an individual may receive other than the salary paid by their employer. This miscellaneous income can span from dividends and royalties to self-employment earnings and bank interest. Getting a blank 1099 tax form is the first step in preparing to report your miscellaneous income. This form acts as a kind of roadmap, guiding how to describe and record your non-wage income accurately. The importance of this form shouldn’t be underestimated - it can make the difference between a smooth tax experience and unexpected back taxes or penalties. Who Can't Use the 1099 Tax Form While it's a powerful tool, not everyone can use the federal tax form 1099. It's specifically designed for individual taxpayers—not corporations. If you're a company or other business organization, you'll need to use other forms to report your income, such as Form 1120 for corporations or Form 1065 for partnerships. Government entities, tax-exempt organizations, and certain other entities are also ineligible to use Form 1099. Form 1099 on a Real-Life Example Let's consider a scenario: imagine you are a freelance graphic designer who also earns a bit of income from a hobby of creating and selling handmade crafts. You need to report both income streams, but neither is tied to a traditional employer who pays you a regular salary. In this case, you would use Form 1099 to report these additional earnings. It shows the IRS that you’re not just a salaried employee but also have income from self-employment and other sources. You must print the 1099 tax form, fill it out correctly, and submit it with your regular income tax filing. Common Issues & Their Solutions Incorrect or Missing Taxpayer Identification Number (TIN)If you receive a notice from the IRS about a TIN mismatch, provide the correct TIN to the payer or the IRS as requested. Missing 1099 FormsContact the payer and request a copy of the missing 1099 form. You can also report the income based on your records if necessary. Failure to Report All IncomeIf you realize you omitted income, file the 1099 tax form but its amended copy with the correct information and pay any additional taxes owed. Mismatched Income AmountsContact the payer to resolve discrepancies. If the payer made an error, request a corrected 1099 form. Not Keeping Backup RecordsYou can refer to your backup records if you lose your copies or need to provide documentation. By better understanding Form 1099, you can take control of your income, better understand your tax obligations, and avoid potential complications. Hopefully, this essential guide has clarified its purpose, highlighted who can't use it, shown practical applications, and addressed common issues people often encounter. Fill Now -

![image]() IRS 1099 Form for 2023 The IRS 1099 form in 2023 is an integral document that comes in various versions for various purposes. In essence, IRS Form 1099 covers an extensive list of income sources, ranging from independent contractor income to distribution from retirement accounts and more. Today, we'll delve into specific types of 1099 forms and their uses, focusing on the 1099-SA and 1099-MISC forms. Usage of 1099-SA & 1099-MISC Forms The 1099-SA form is utilized when you've received distributions from an HSA, Archer MSA, or Medicare Advantage MSA. The HSA or MSA trustee or custodian uses this form to report your distributions. On the other side, the 1099-MISC form is specifically designed for reporting miscellaneous income. This could include payments made in the course of a trade or business to a person who's not an employee or to an unincorporated business. As you can see, in 2023, the 1099 tax form continues to play a crucial role in your income tax reporting and filing. IRS Form 1099 for Nonprofit Organizations It's not just businesses and individuals who need to be conversant with the 1093 form. Nonprofit organizations also have to navigate this landscape carefully, particularly when dealing with contractors, vendors, and other payments. To ensure that you print the 1099 form for 2023 correctly, it's crucial to gather all the necessary information from your contractors, vendors, and service providers. This typically comes as a W-9 form, which gives you the details you need for accurate 1099 reporting. The 1099 Forms and IRS Audits 1099 forms can come into play during IRS audits. The IRS uses these forms to help ensure that all taxpayers - including individuals, businesses, and nonprofits - are reporting their income correctly. If you've received a 1099 form, including this when you file your taxes is essential, as the IRS also receives a copy. Not doing so could result in discrepancies in your reported income and kickstart an audit. Make sure to have a 1099 printable form for 2023 handy, as it can greatly help in such situations. Understanding and correctly using 1099 forms is crucial to tax preparation. Whether you're an individual, a business, or a nonprofit, being informed about these forms can help ensure you're accurately reporting all your income. If you need to, don't hesitate to take advantage of the 2023 Form 1099 in PDF format from our website, which can be filled in digitally or printed out for your convenience. It can significantly simplify your tax filing process, so make sure to use it wisely. Fill Now

IRS 1099 Form for 2023 The IRS 1099 form in 2023 is an integral document that comes in various versions for various purposes. In essence, IRS Form 1099 covers an extensive list of income sources, ranging from independent contractor income to distribution from retirement accounts and more. Today, we'll delve into specific types of 1099 forms and their uses, focusing on the 1099-SA and 1099-MISC forms. Usage of 1099-SA & 1099-MISC Forms The 1099-SA form is utilized when you've received distributions from an HSA, Archer MSA, or Medicare Advantage MSA. The HSA or MSA trustee or custodian uses this form to report your distributions. On the other side, the 1099-MISC form is specifically designed for reporting miscellaneous income. This could include payments made in the course of a trade or business to a person who's not an employee or to an unincorporated business. As you can see, in 2023, the 1099 tax form continues to play a crucial role in your income tax reporting and filing. IRS Form 1099 for Nonprofit Organizations It's not just businesses and individuals who need to be conversant with the 1093 form. Nonprofit organizations also have to navigate this landscape carefully, particularly when dealing with contractors, vendors, and other payments. To ensure that you print the 1099 form for 2023 correctly, it's crucial to gather all the necessary information from your contractors, vendors, and service providers. This typically comes as a W-9 form, which gives you the details you need for accurate 1099 reporting. The 1099 Forms and IRS Audits 1099 forms can come into play during IRS audits. The IRS uses these forms to help ensure that all taxpayers - including individuals, businesses, and nonprofits - are reporting their income correctly. If you've received a 1099 form, including this when you file your taxes is essential, as the IRS also receives a copy. Not doing so could result in discrepancies in your reported income and kickstart an audit. Make sure to have a 1099 printable form for 2023 handy, as it can greatly help in such situations. Understanding and correctly using 1099 forms is crucial to tax preparation. Whether you're an individual, a business, or a nonprofit, being informed about these forms can help ensure you're accurately reporting all your income. If you need to, don't hesitate to take advantage of the 2023 Form 1099 in PDF format from our website, which can be filled in digitally or printed out for your convenience. It can significantly simplify your tax filing process, so make sure to use it wisely. Fill Now